1. Introduction

In today’s volatile global economy, companies purchasing high-performance metals and alloys (e.g. tungsten carbide, superalloys, specialty steels, cobalt or nickel alloys) face a host of supply chain disruptions and uncertainties. From escalating raw material prices to changes in trade policy and quality inconsistencies, the challenges are real—and the stakes are high.

This article delves into the primary challenges in global metal / alloy supply chains, analyzes their implications for buyers, and proposes actionable strategies to mitigate risk, strengthen procurement resilience, and maintain performance integrity.

2. Major Challenges in the Metal & Alloy Supply Chain

2.1 Raw Material Volatility & Critical Metals Supply Risk

Many high-performance alloys depend on critical metals whose supply is constrained by geography, regulation, or limited sources. Elements like cobalt, molybdenum, titanium, niobium, or chromium often see large price swings or supply bottlenecks.

For example, procurement teams frequently cite fluctuating metal prices as a top challenge in their budgeting and contract planning. nomoq.in

Moreover, for corrosion-resistant alloys (CRAs) like Alloy 625 or 6Mo, the cost and availability of nickel, molybdenum, or chromium feedstock form a large share of the material cost, making these alloys especially sensitive to raw material disruptions. Parker Hannifin Corporation

This concentration of supply can also raise geopolitical risk—for instance, Europe still depends heavily on a few Russian titanium suppliers, making efforts to “decouple” from that dependency a strategic challenge. Reuters

In academic research, new alloy-design approaches now incorporate supply risk as a design objective, showing that performance and supply sustainability must be balanced. arXiv

2.2 Trade Barriers, Tariffs & Regulatory Uncertainty

Import tariffs, quotas, and shifting trade policies can drastically alter effective material costs or sourcing routes. For steel and aluminum, for example, service centers have reported increased volatility and restricted import flexibility under new tariffs. Loftis Steel & Aluminum

Export controls in producing countries, licensing restrictions, or anti-dumping measures can also reduce the flow of alloy raw materials or intermediate products.

Buyers must also navigate regulatory regimes like conflict minerals / due diligence regulations, especially for tungsten, tantalum, tin, and related metals. 维基百科

2.3 Logistics, Lead Times & Transport Bottlenecks

Transporting dense metal products is expensive and susceptible to disruptions: port congestion, container shortages, freight surcharges, customs delays all can inflate lead times or costs.

In the aerospace / aluminum sector, some lead times have stretched from 80+ weeks to 90+ weeks or more, forcing buyers to plan further in advance. New Source Corporation

Delays translate into missed production schedules or overstocking, both of which erode margins or tie up capital.

It’s not enough to get material delivered; the alloy must meet exacting specifications in chemical composition, microstructure, mechanical properties, and impurity control. Variability or hidden defects can lead to part failure or unexpected scrap.

Parker’s whitepaper on procurement of corrosion-resistant alloys warns that even visually identical products may perform very differently under service conditions if processing quality is poor. Parker Hannifin Corporation

When supply chains are long and fragmented (raw → alloying → processing → finishing), traceability becomes harder, and the risk of supplier substitution or degradation increases.

2.5 Overconcentration & Single-Source Risk

In many alloy sectors, a few dominant producers or mines control large share of supply. That means if one is disrupted, buyers may have few viable alternatives.

Consolidation in supplier tiers further reduces flexibility. In aerospace procurement studies, supply chain consolidation is cited as a structural vulnerability. McKinsey & Company+1

2.6 ESG / Sustainability & Environmental Constraints

Increasingly, buyers are pressured to source “green metals” with lower carbon footprints, ethical mining practices, and full supply chain transparency.

Regulations may limit mining activity in certain regions, push stricter emissions controls, or penalize materials with high embedded carbon. These pressures restrict supply and increase costs over the medium term.

3. Effects & Risks Faced by Alloy Buyers

These upstream challenges cascade down into real risks for buyers of metal / alloy parts:

- Price volatility / margin erosion: raw material surges squeeze margins

- Unpredictable lead times / delays: production schedules go off track

- Quality failures / rejections: bad materials lead to scrap, warranty costs, performance issues

- Stockouts / supply interruptions: inability to fulfill orders or meet maintenance cycles

- Capital tied in inventory: holding safety stock increases working capital

- Contract risk: suppliers pushing change orders, minimums, or short notice adjustments

For buyers of high-performance alloys like carbides, superalloys, or specialty metals, these impacts are magnified because tolerances and performance are less forgiving.

4. Strategic Mitigation Strategies for Alloy / Metal Buyers

Here are tactics you can apply to build resilience and reduce exposure:

4.1 Diversify Suppliers & Multi-Sourcing

Don’t rely on single suppliers or one geographic region. Qualify alternative suppliers in different countries or regions to buffer disruptions.

4.2 Build Strategic Supplier Partnerships

Go beyond transactional relationships. Share forecasts, plan jointly, establish preferred / priority status, co-invest if possible—this builds trust and priority in tight supply.

4.3 Maintain Buffer Inventory & Rolling Forecasts

For critical alloys / components, maintain safety stock or intermediate storage. Use rolling, multi-year forecasts to give upstream suppliers visibility and lead time.

4.4 Negotiate Flexible Contracts & Risk-Sharing Clauses

Incorporate escalation formulas, hedging mechanisms, change-order buffers, and cost-sharing for surcharges or shipping spikes.

4.5 Implement Strict Quality & Traceability Controls

Require full material test certificates, third-party audits, incoming inspection, and traceability throughout the supply chain.

Reject or flag any batch that deviates from standards. Over time, build your own quality database and supplier scorecards.

4.6 Consider Near-Shore / Local / Vertical Integration

Where feasible, source alloys closer to your manufacturing base to reduce shipping / trade risks. Consider partial vertical integration (e.g. alloying, preprocessing) if volumes justify the investment.

4.7 Design Flexibility & Alternative Alloy Options

In your designs, allow for multiple alloy grades or subcomponent replacement. Use modular parts so that high-risk components can be swapped. Explore hybrid material solutions that reduce reliance on a single high-risk alloy.

4.8 Monitor Market & Policy Trends Proactively

Stay abreast of geopolitical shifts, export controls, metal market indices, and environmental policy changes. Use market intelligence to anticipate disruptions rather than react to them.

5. How Panda Carbide Adds Value as a Sourcing Partner

To stand out in this challenging landscape, alloy / metal suppliers must do more than just sell materials—they must be reliable supply risk partners. Here’s how Pandacarbide can help:

- Multiple sourcing channels and backup supplier network

- Strict traceability and audit-capable documentation

- Proactive inventory planning and flexible lead-time management

- In-house lab / testing capabilities to guarantee material quality

- Collaborative forecasting and demand planning with clients

- Technical support to propose alternative alloys or hybrid materials

- ESG / green manufacturing credentials to meet sustainability demands

By positioning your company not just as a vendor but as a resilient supply partner, you attract buyers who are not just price-sensitive but reliability-conscious.

6. Buyer’s Action Plan: Next Steps

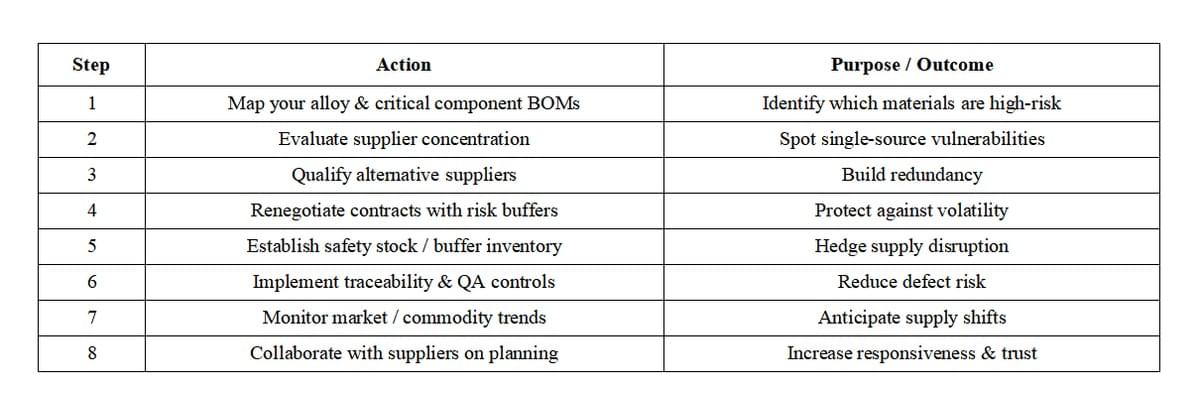

Here’s a practical roadmap for procurement / materials teams:

7. Conclusion

The global metal and alloy supply chain is under growing strain from raw material volatility, shifting trade policies, logistics challenges, quality inconsistency, and supplier concentration. For buyers of premium alloys and metal components, these pressures are not hypothetical—they directly impact cost, delivery, and product reliability.

By proactively applying strategies like diversification, supplier collaboration, buffer inventory, quality controls, and design flexibility, alloy buyers can mitigate much of the risk. And by partnering with suppliers who offer transparency, backup capacity, and technical support, buyers can elevate their sourcing from transactional to strategic.

If you’re a procurement engineer, materials expert, or supply chain manager grappling with alloy supply uncertainty—reach out to us at Panda Carbide. We’d be happy to review your alloy sourcing risks, propose alternative strategies, or provide sample solutions to enhance your supply resilience.

Panda Carbide-More Than Tough!

Panda Carbide Technology CO., LTD.